User-Centered Product Innovation at Capital One

Client: Capital One

Role: Senior Product Experience Consultant

Dates: Q3 2021 - Q2 2022

Project Overview

Capital One launched a new unit focused on novel ways to monetize Card assets through scalable, SaaS models. The head of the new unit brought me in to help them research and design their first product. The team's initial focus was on the rapidly expanding direct-to-consumer (DTC) e-commerce sector - a market heavily targeted with new fintech solutions like BNPL.

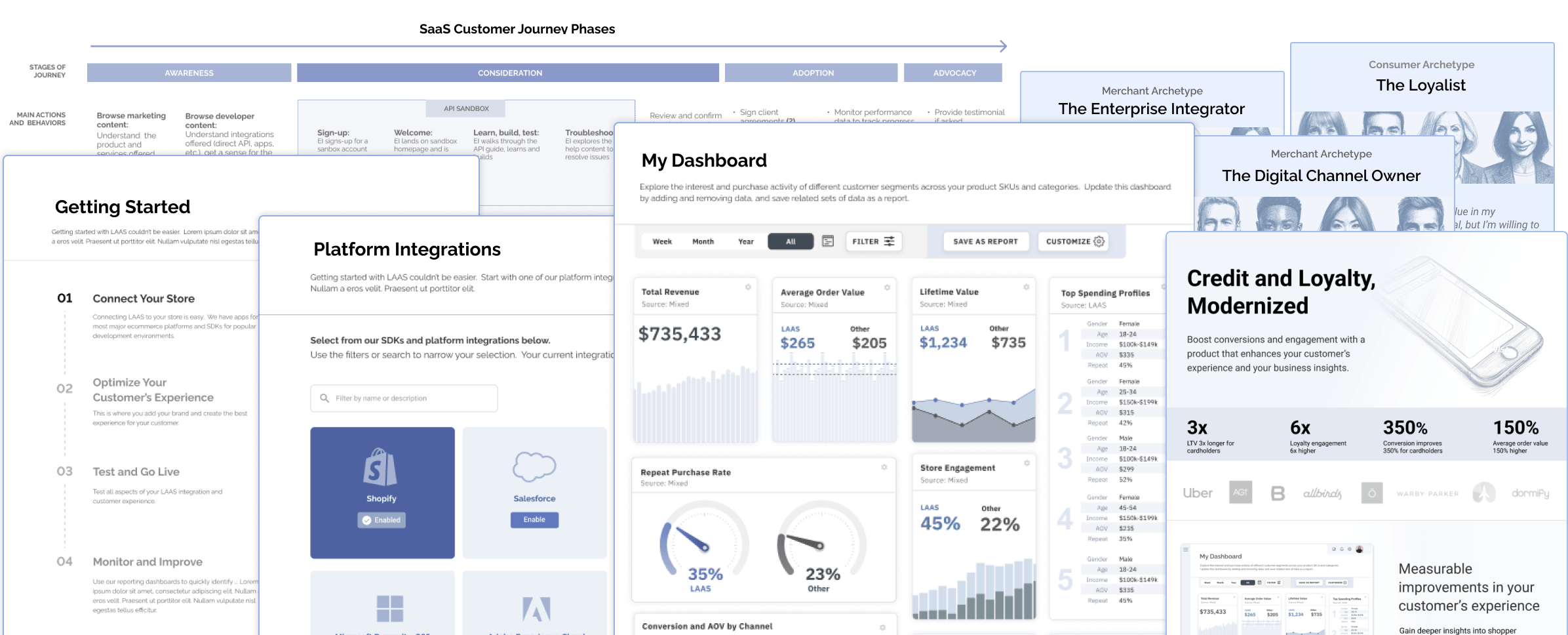

This case study showcases the comprehensive UX process we used: conducting extensive user research, developing journey maps and personas, creating and validating prototypes, and building stakeholder alignment - all while balancing merchant, consumer and business needs in a complex B2B2C ecosystem.

My Role at a Glance

- Participated in research design and analysis of 40+ hours of moderated user interviews spanning 20 merchants and 20 consumers

- Synthesized research findings through collaborative exercises including affinity mapping, journey mapping, and persona development

- Developed and validated multiple rounds of wireframes and prototypes with merchants, consumers, and internal stakeholders

- Coordinated iterative design reviews and validation sessions with cross-functional stakeholders to balance user needs, technical feasibility, and business goals

Research & Discovery

Our research approach combined multiple methodologies to develop a comprehensive understanding of both merchant and consumer needs:

Primary Research

- In-depth interviews (IDIs) with 20 merchants and 20 consumers

- Structured research phases progressing from broad exploration to specific concept validation

- Multi-stakeholder synthesis sessions using affinity mapping to identify key themes

- Journey mapping workshops to visualize current pain points and opportunities

Market Analysis

- Partnership with Capital One Research to analyze emerging SaaS payment solutions

- Competitive analysis of BNPL offerings and loyalty programs

- Best practices review of merchant onboarding and platform integration

Key Findings

Over the course of our interviews and analysis, patterns emerged around merchant capabilities and consumer preferences that would shape our solution strategy.

Merchants

Resource Constraints

Limited technical resources and crowded roadmaps made new integrations challenging.

"We would love to try new tools, but our tech is stretched thin ... if it's low effort and high lift... it'll probably start near the top of our roadmap."

Data Needs

A very strong desire for customer insights from new data sources.

"...basically, for the past few years, it's been all about data ... the more of it you have, the more we like you..."

CX Control & Customization

A desire to keep customer experiences 'on-brand' without significant overhead.

"We're very proud of our brand and experience, and so we wouldn't add anything ... that we don't have a great deal of control [over]."

Consumers

Application and Approval Transparency

Consumers emphasized the need for clear, upfront information about the application and approval process, including credit requirements and potential impacts.

"I want to know what I'm getting into before I apply. Will there be a credit check? How long does approval take? Is it pre-approved?"

Flexible Payments

Strong interest in transparent payment options like BNPL, with clear terms and interest rates that help them plan their purchases.

"I like seeing some payment options and what they'll cost ... things like paying over time or using points ... and seeing those at the time of purchase."

From Insights to Solutions: Iterative Design Process

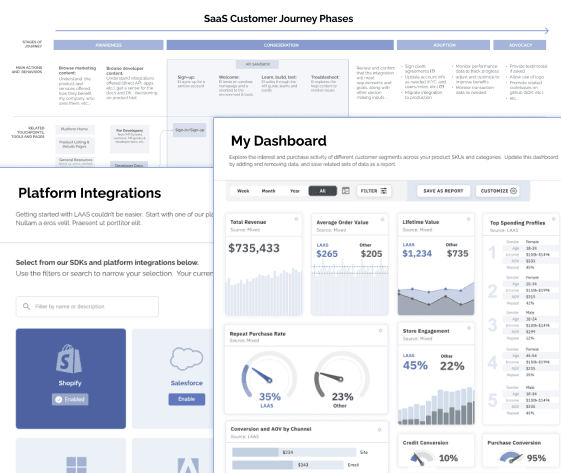

From our research insights, we began ideating on potential solutions. We iterated through low-fi concepts with rapid feedback loops. Our ideas were refined through multiple rounds of validation with merchants, consumers, and internal teams, as we progressed from rough, low-fi representations of milestone screens to an end-to-end prototype of the product experience.

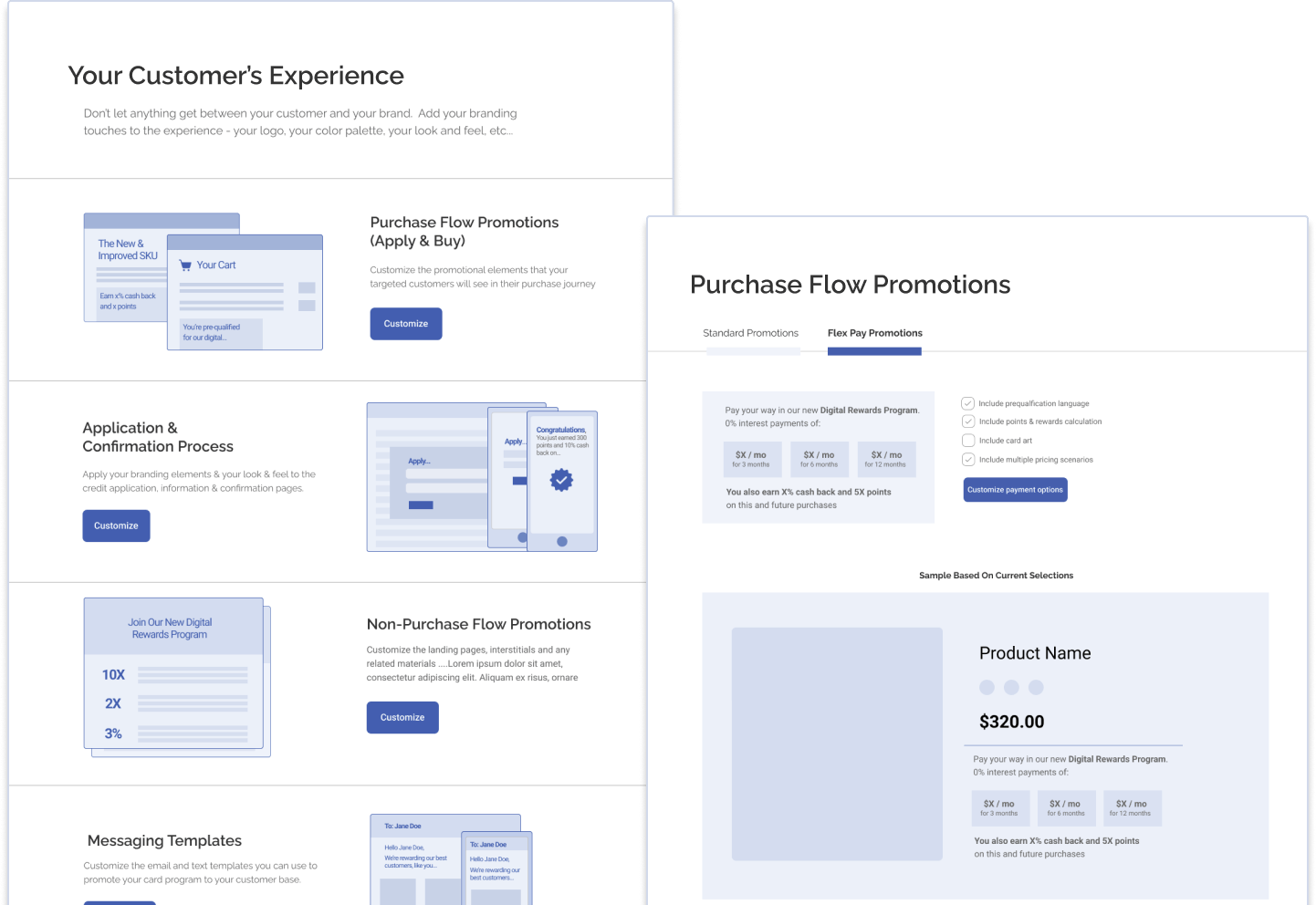

Below is a sampling of screens from our final prototype, which we scaffolded at mid-fidelity level for our final presentation to stakeholders. This approach allowed us to present a product prototype to merchants, consumers, and senior stakeholders who might not be familiar with evaluating rough, low-fidelity experiences. We were able to maintain wireframe velocity while presenting a product experience where elements like color palettes, branding, typography, and imagery are clearly out of scope.

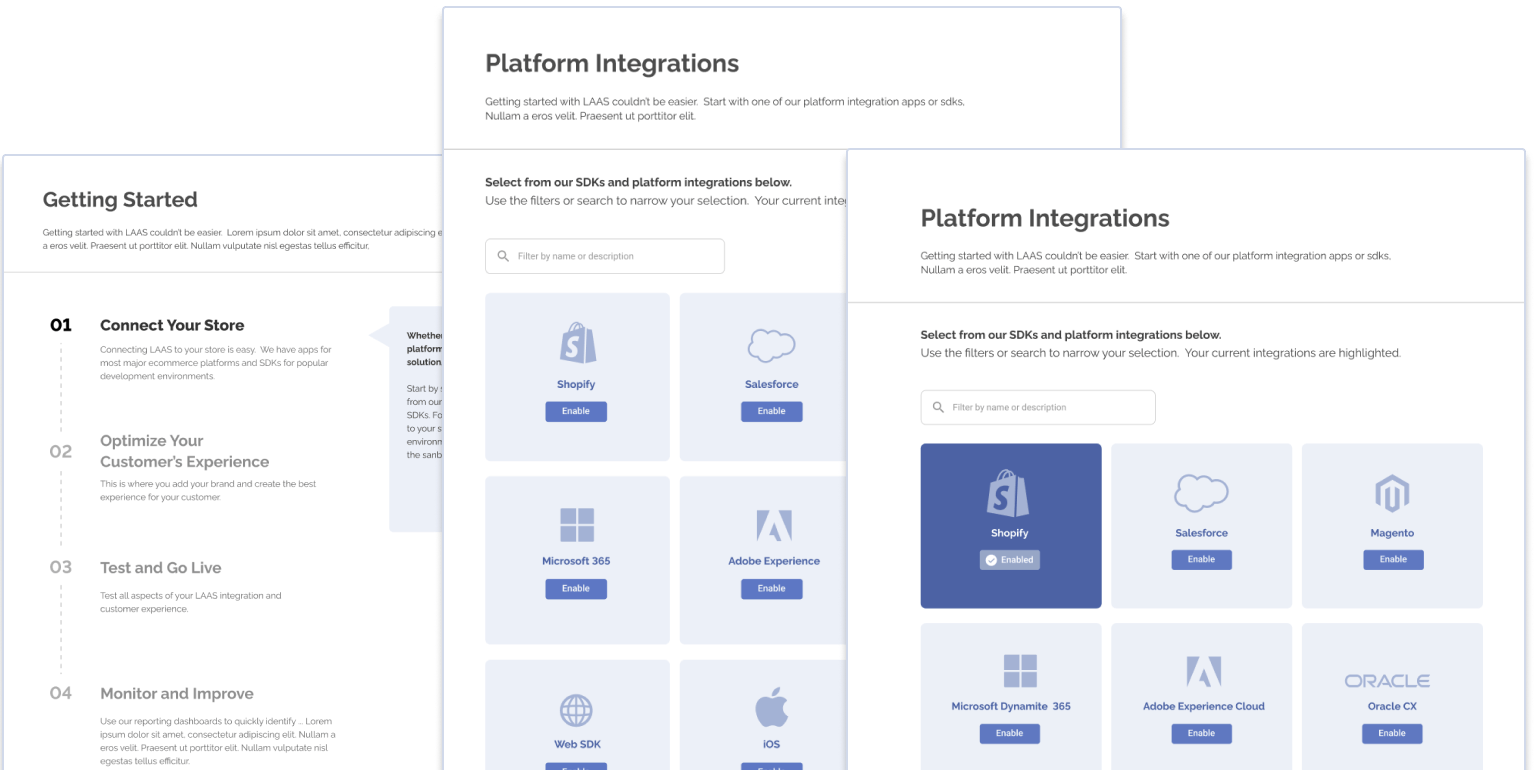

Low-Code/No-Code Integration

Addressing the resource constraints expressed by merchants, we developed a low-code/no-code integration solution. This feature significantly simplifies the onboarding process for resource-constrained merchants while still offering customization options to maintain brand consistency.

Through collaborative sessions with both technical and non-technical merchant stakeholders, we refined this solution to strike the right balance between ease of use and functionality. The result is a flexible system that can be quickly implemented by merchants of varying technical capabilities.

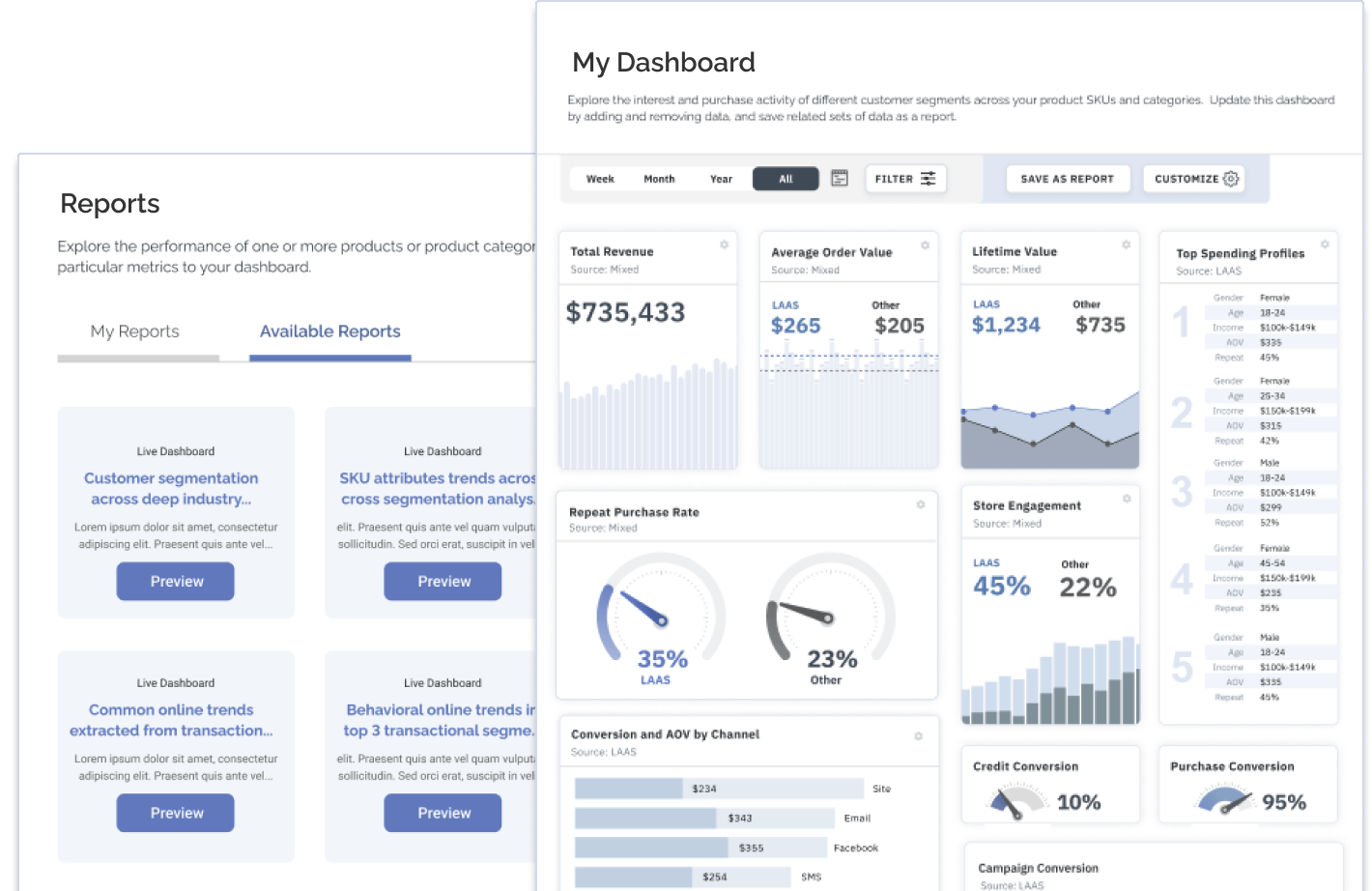

Merchant Analytics & Reporting

Responding to merchants' strong desire for actionable customer insights, we designed a comprehensive analytics dashboard. This tool provides real-time data on customer behavior and program performance, presented in easy-to-understand visualizations.

We went through several iterations of the dashboard design, continuously refining based on merchant feedback to ensure that the most crucial data points were easily accessible and actionable. The final design allows merchants to quickly gain insights and make informed decisions without requiring extensive data analysis skills.

Control On Store Branding and Experience

To meet consumers' expectations for a frictionless journey and address their desire for clarity at every step, we developed a seamless and transparent shopping experience. This comprehensive approach integrates clear messaging, flexible payment options, and smooth user flows.

Through rapid prototyping and user testing, we refined the presentation of these options to ensure maximum clarity and ease of understanding. The final design integrates seamlessly into the checkout process, providing consumers with clear information about each payment option without disrupting their shopping experience.

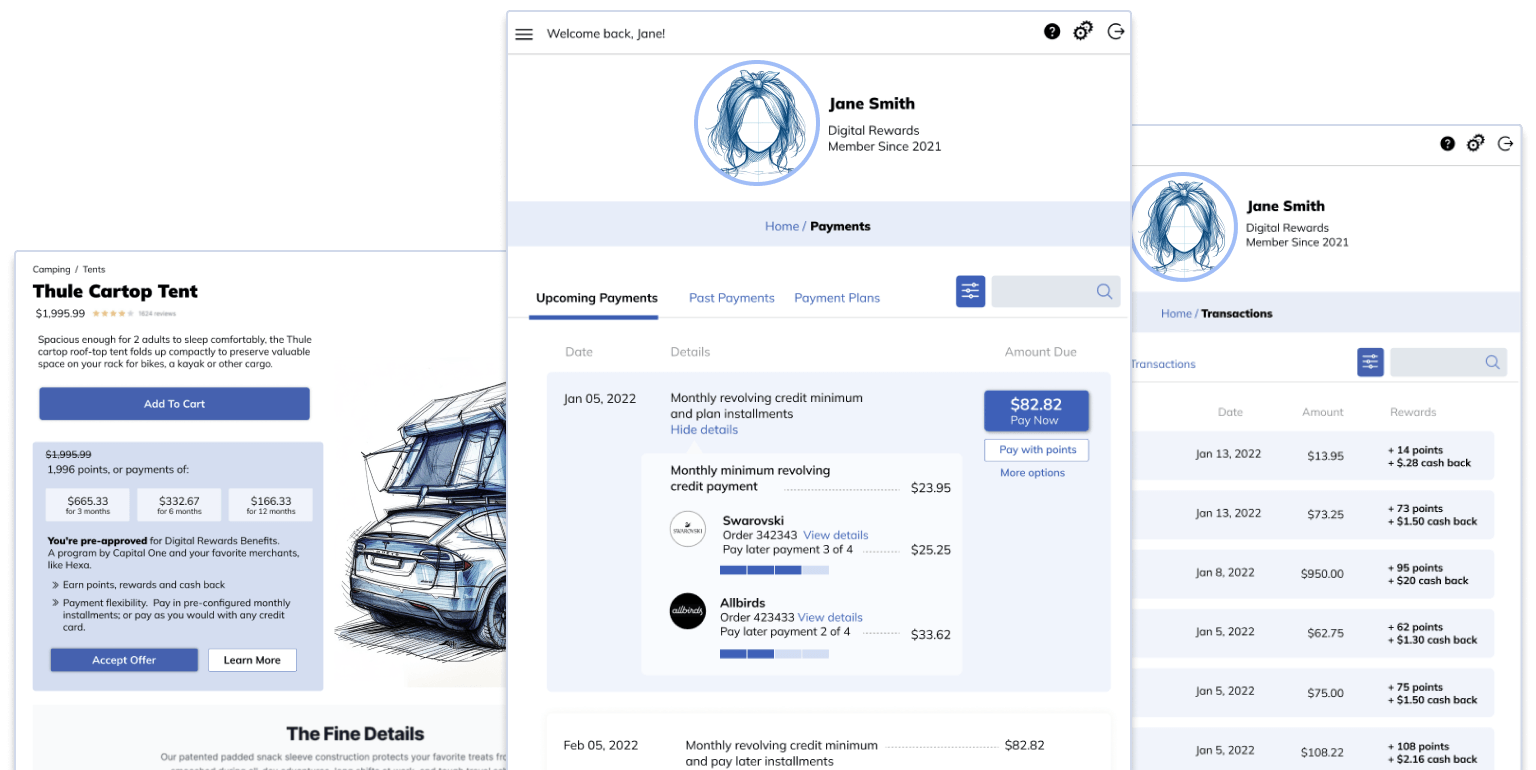

Seamless & Transparent Consumer Shopping Experience

To meet consumers' expectations for a frictionless journey and address their desire for clarity at every step, we developed a seamless and transparent shopping experience. This comprehensive approach integrates clear messaging, flexible payment options, and smooth user flows.

Through rapid prototyping and user testing, we refined the presentation of these options to ensure maximum clarity and ease of understanding. The final design integrates seamlessly into the checkout process, providing consumers with clear information about each payment option without disrupting their shopping experience.

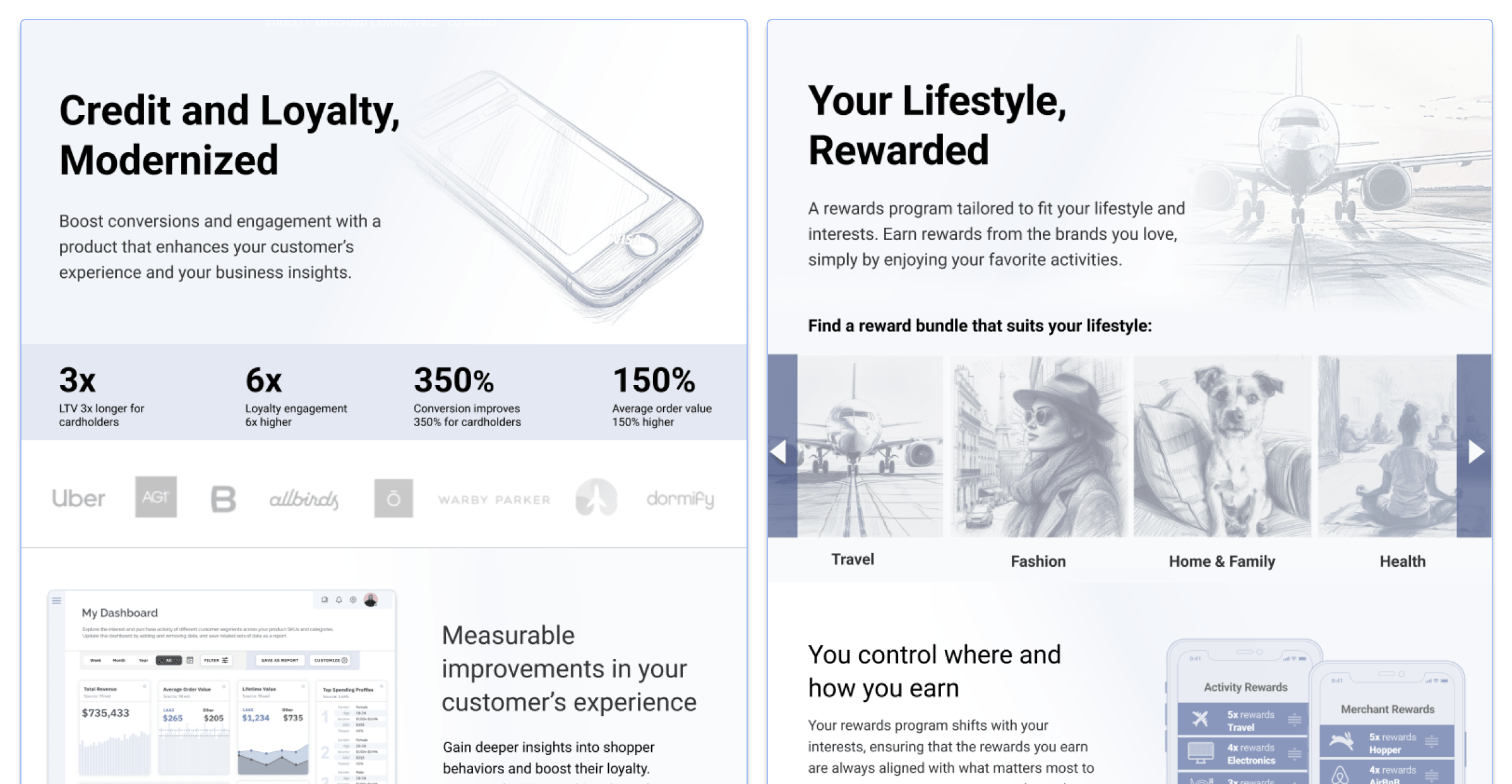

Multi-Merchant Loyalty Program

Addressing the consumer preference for cross-brand rewards and the merchant need for customer retention, we conceptualized a networked loyalty program. This allows consumers to earn and redeem points across multiple participating merchants, particularly appealing to shoppers of specialty DTC brands.

We iterated on this concept through multiple rounds of merchant and consumer feedback, refining the balance between program flexibility and ease of use. The result is a system that offers consumers more value and choice while providing merchants with a powerful tool for customer acquisition and retention.

Throughout this process, we maintained close collaboration with internal stakeholders from business, compliance, and engineering teams. This ensured that our innovative solutions not only met user needs but also aligned with Capital One's regulatory requirements and technical capabilities.

By continuously iterating and refining our designs based on user feedback and stakeholder input, we were able to develop a comprehensive solution that addresses key pain points for both merchants and consumers while pushing the boundaries of what's possible in the e-commerce loyalty and credit space.

Impact & Outcomes

We presented our research process, key insights, and full product prototype to a broad group of Capital One stakeholders.

The positive reception led to a significant expansion of our project scope - an enterprise-wide SaaS platform that would:

- Institutionalize the best practices demonstrated in our approach and final product

- Host our novel credit and loyalty solution, and other SaaS products developed across the enterprise

This separate SaaS platform initiative will be detailed in an upcoming case study.

Interested in learning more about this project or discussing similar challenges?